Press Releases

Colebrook Financial Renews $12 mm Hypothecation Line of Credit with Breckenridge Grand Vacations (January 2026)MIDDLETOWN, CT (January 2026) – Colebrook Financial, a leading lender to the timeshare and travel club industries, has renewed a $12mm hypothecation loan to Gold Point Lodging and Realty, part of the Breckenridge Grand Vacations (BGV) companies. This loan provides flexible working capital to support sales at Breckenridge Grand Vacations’ (BGV) Grand Timber Lodge, one of the companies three Breckenridge resorts.

The renewal reflects enduring demand for vacation ownership in the mountain resort market and increases Colebrook’s cumulative funding to BGV to more than $70 million since 2009. Breckenridge properties continually command some of the highest prices in the timeshare industry.

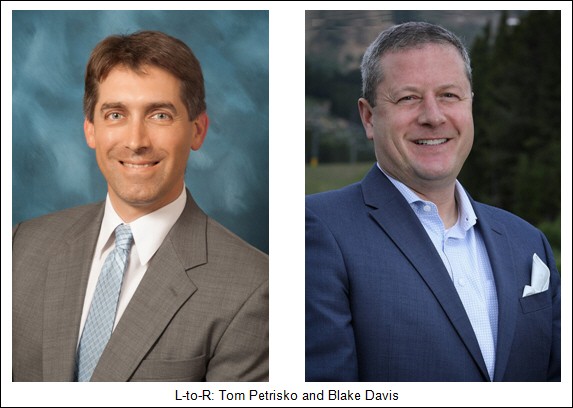

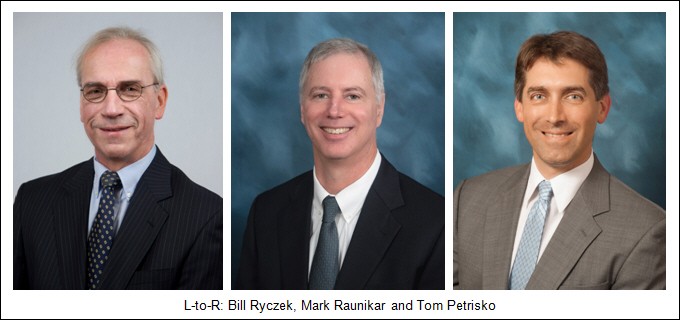

The recent renewal emphasizes the value Colebrook Financial Company places on long term relationships. “Breckenridge Grand Vacations is one of the largest and best independent timeshare developers in the United States, and while Colebrook is delighted to have had an excellent relationship with them since 2009, I have enjoyed working with everyone at BGV for more than 20 years. I look forward to many more years of helping BGV continue their success and cannot wait to see the completion of their next, even grander project – The Imperial Hotel and private residences in Breckenridge,” said Tom Petrisko, Principal of Colebrook.

Blake Davis, Chief Financial Officer, Breckenridge Grand Vacations shared, “Colebrook has been an instrumental partner of BGV’s for over 15 years. Their financing flexibility and creativity has helped BGV continue to grow and expand.”

Founded in 2003, Colebrook Financial is a privately held commercial lender specializing in the timeshare and resort industry. Based in Middletown, Connecticut, Colebrook provides customized financing for developers, HOAs, and management companies across the United States, Mexico, and the Caribbean. The firm’s principals bring decades of resort lending experience and are known for service, flexibility, and deep industry experience.

Breckenridge Grand Vacations, a Colorado based real estate development and property management company is the developer and parent company of Grand Timber Lodge, the Grand Lodge on Peak 7, the Grand Colorado on Peak 8, and the Breck Inn. BGV has been bringing families together and creating grand vacations since 1984.

Colebrook Financial Funds $5 Million Interim Mortgage Re-Purposing Loan for Brewtown Living – The Dunes at Coastal Point (December 2025)

MIDDLETOWN, CT (December 2025) – Colebrook Financial, a leading lender to the timeshare and travel club industries, has funded a $5 Million interim mortgage loan to Zealandia Holding Company of Asheville, NC for the re-purposing of Phase III of Peppertree Atlantic Beach Resort from timeshare units to apartment rentals.

Part of the Zealandia Holdings family of companies based in Asheville, NC, Peppertree Atlantic Beach Resort was built in the 1980s and is a beach vacation resort close to restaurants and shops. To adapt to the changing needs of the owners, the decision was made to give new life to Phase III and repurpose these units to apartment rentals. Colebrook has been lending to the Zealandia organization since 2003, including hypothecation loans, HOA loans, inventory loans, loans secured by management contracts, re-purposing loans, and acquisition loans.

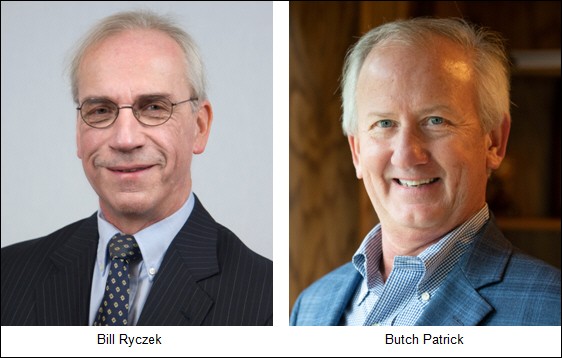

Bill Ryczek, Principal/Colebrook Financial, said, “The Zealandia and Colebrook organizations are each very different than when we began doing business together in 2003. One of the reasons we both remain in business and profitable is that we’ve adapted to the changing world around us. In the case of Zealandia that meant realizing that unused timeshare inventory had great value in other use and that many of its timeshare owners had aged out and would welcome the opportunity to cash out their interests. Since 2021, Colebrook has made eight loans totaling more than $27mm to the Zealandia organization to assist in the re-purposing of its former timeshare resorts. It’s been a great 22-year relationship.”

Butch Patrick, CEO of Zealandia Holdings, shared, “In 2019, I made the decision to exit timeshare and reposition our controlled properties to Resort Hotels, Multi-Family apartments or sell outright. To accomplish this, I knew it would require significant capital to buy out the timeshare owners and renovate the properties. With Colebrook, I had a long-term lender that had been key to our success in timeshare and knew our capacities well. When I approached Bill, he was receptive to our strategy and soon made a commitment to fund some of our projects. What started small has expanded and like before, Colebrook plays a critical role in our repositioning strategy. We are very fortunate to have them as a partner.”

Founded in 2003, Colebrook Financial is a privately held commercial lender specializing in the timeshare and resort industry. Based in Middletown, Connecticut, Colebrook provides customized financing for developers, HOAs, and management companies across the United States, Mexico, and the Caribbean. The firm’s principals bring decades of resort lending experience and are known for service, flexibility, and deep industry experience.

Zealandia Holding Company, Inc. (ZHC) is a value-added strategic investor. Since its inception, ZHC has acquired or invested in 22 companies covering a wide range of resort properties, hotels, and multi-family real estate and related businesses. ZHC’s strong, 21-year history of operational excellence, brand development and sector expertise combine to further its mission to provide the necessary capital, core function management, and strategic leadership needed for sustained growth.

Colebrook Financial Closes $5 Million Loan with Myrmex Vacation Residential Club to Support Growth in Mexico (June 2025)

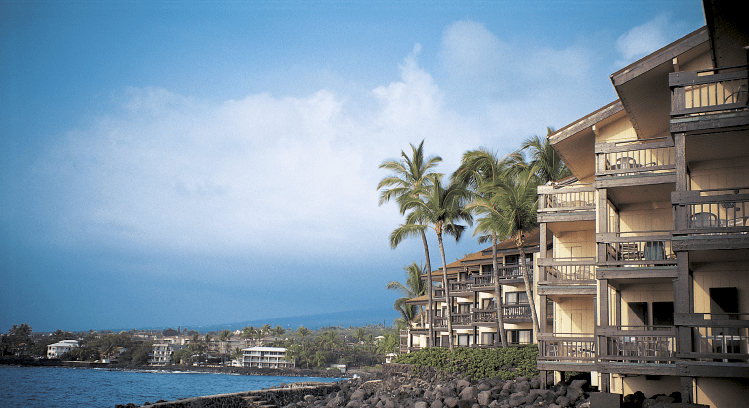

MIDDLETOWN, CT (June 2025) – Colebrook Financial, a premier lender serving the timeshare and travel club industries, is proud to announce the closing of a $5 million hypothecation loan with Myrmex Vacation Residential Club, operator of the 74-unit Los Cabos Golf Resort in Cabo San Lucas, part of the Trademark Collection by Wyndham.

This strategic financing supports Myrmex's continued growth and reflects Colebrook’s commitment to expanding its footprint in Mexico, a market with strong potential and limited access to specialized timeshare financing.

"Los Cabos Golf Resort is a beautiful, newly built facility with quality and service that clearly resonates in its pricing," said Bill Ryczek, Principal at Colebrook Financial. "Jose and his team have exciting growth prospects, and we’re thrilled to support them as they scale. Mexico remains an under-served market for timeshare lending, but we see great opportunity. While we’ll continue to be selective, our track record gives us confidence to build further in the region."

“The hypothecation loan process was new to us,” said Myrmex President and CEO Jose Gomez Lozado, “and Colebrook was great about explaining everything and always being there when we had questions.”

Founded in 2003, Colebrook Financial has been a trusted financing partner in the timeshare industry for over two decades and began its lending activity in Mexico in 2005. Headquartered in Middletown, Connecticut, Colebrook offers tailored financial solutions ranging from $100,000 to over $30 million, supporting developers across North America.

Colebrook Financial Increases Hypothecation Loan to $18 Million for InnSeason Resorts (June 2025)

MIDDLETOWN, CT (June 2025) – Colebrook Financial, a leading lender to the timeshare and travel club industries, is pleased to announce that it has increased its hypothecation loan with InnSeason Resorts to $18 million.

The InnSeason Resorts brand has supported the local New England economy for more than 20 years, playing its part in the billion-dollar tourism industry. Working capital provided by Colebrook makes its way back into the local economy by enabling InnSeason to generate new member sales and employment opportunities, while visitors to its resorts patronize the local restaurants and area attractions. According to ARDA statistics, timeshare resorts in the US generated $3 billion in rental income in 2023 and directly added about $35.7 billion to the US economy.

“We are excited that InnSeason Resorts continues to grow, with new owners/members, which necessitates the need for an increase in our hypothecation line. We feel fortunate to have a great partner within Colebrook Financial who has helped us to facilitate an increase in our loan. Mark, Bill and Melinda are great to work with and try to make the loan process as easy, seamless and expedient as possible” shared Cathrine Leyden, Chief Operating Officer with InnSeason Resorts.

Mark Raunikar, Partner at Colebrook Financial stated, “With both of our companies based here in New England, we have known Dennis and Billy for many years. They each bring complementary skills of development, management and sales to their partnership that contribute to the success of their ventures over many decades. They have a strong management team led by Chief Operating Officer Cathy Leyden, and we have thoroughly enjoyed our relationship with InnSeason since closing our first transaction with them in 2021. InnSeason Resorts is an important customer, and we hope to continue earning their business by providing excellent service and attention to detail.”

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more.

InnSeason Resorts was born with the vision of sharing the uniqueness and charm of New England with the world. As New England natives, owners Billy Curran and Dennis Ducharme embarked on a journey to create the premier vacation ownership experience in the Northeast. InnSeason Resorts is the largest independent vacation ownership developer and operator in the Northeast and one of the largest in North America. Focusing on our customers first and foremost, the InnSeason portfolio spans 6 resorts under ownership, a growing array of managed resorts, and an ever-expanding roster of member families.

Colebrook Financial Funds $5.8 Million Repurposing Project for Church Street Inn (March 2025)

MIDDLETOWN, CT (March 2025) – Colebrook Financial, a leading lender to the timeshare and travel club industries, provided a $5.8 million repurposing loan to LaTour Hotels and Resorts, a subsidiary of the Zealandia Holding Company of Asheville, North Carolina.

An upscale resort hotel, Church Street Inn, Charleston, South Carolina, operated as a timeshare resort beginning in 1985. In December 2024, as the number of owners declined through attrition, the owners voted to terminate the timeshare regime and repurpose the property to a resort hotel. Each timeshare owner received a distribution.

Bill Ryczek, Principal/Colebrook Financial, said, “Repurposing is becoming a larger part of the timeshare industry as owners age out and older properties need refurbishment. In essence, we’ve repurposed our relationship with the Zealandia organization. Beginning in 2003, we made a number of hypothecation loans to them. This is our fifth repurpose transaction. In the first ones, we were learning the business together. Now, Zealandia is one of the experts in the field.”

The 31-unit Church Street Inn, part of the Ascend®Hotel Collection, offers townhouse-style accommodations in downtown Charleston. The property is in the heart of the tourist district, just a few yards from historic Charleston City Market.

Butch Patrick, CEO of Zealandia Holdings, said, “During the 22 years we’ve been working with Colebrook, we’ve always appreciated their willingness to listen to new ideas and try to find a way to accommodate them. They’ve been a great lending partner for us.”

Charleston has long been a prime tourist destination and boasts attractions such as Fort Sumpter, Patriot’s Point Naval and Maritime Museum, harbor cruises, carriage tours, water activities such as fishing and boating, and several historic plantations open for tours. In 2024, the city hosted a record 7.7 million visitors. It was ranked the #1 city for tourism in the United States by Travel + Leisure magazine for the 12th year in a row.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Colebrook Financial Announces New Public Relations and Marketing Relationship (February 2025)

MIDDLETOWN, CT (February 2025) – Colebrook Financial announced that it has contracted for its marketing and public relations functions with someone who, by a remarkable coincidence, has the same surname as one of Colebrook’s partners.

When Jane Raunikar graduated from college, she was hired by the marketing department of a central Connecticut bank. Her first assignment was writing a press release announcing the arrival of a young hot-shot vice president named William J. Ryczek. Jane has spent her entire career in various marketing roles, including her recent engagement handling the marketing and public relations for one of Connecticut’s largest tourist attractions.

"Having known the Colebrook team since their inception, it was an easy decision for me when Bill Ryczek asked if I would join them,” said Jane Raunikar. “With 10 years at The Connecticut River Museum and a number of years at various non-profit entities, I plan to use my marketing experience to build upon Colebrook’s already established strategies."

“After spending several years with Jane in banking,” said Colebrook principal Bill Ryczek, “I was really pleased when she agreed to work with us. It will be good to have her take a fresh look at what we’re doing.”

Added principal Mark Raunikar, “After 22 years, I was finally able to convince Jane that Colebrook might have some staying power. After filling the Director of Marketing role for a number of non-profits, I’m excited that she’s agreed to apply her years of marketing know-how to a for profit business that is closer to home!”

Jane will accompany the Colebrook principals at the upcoming ARDA Conference in Orlando to meet the company’s customers and other industry leaders.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Colebrook Financial Announces Hypothecation Loan for Caribbean Resort (December 2024)

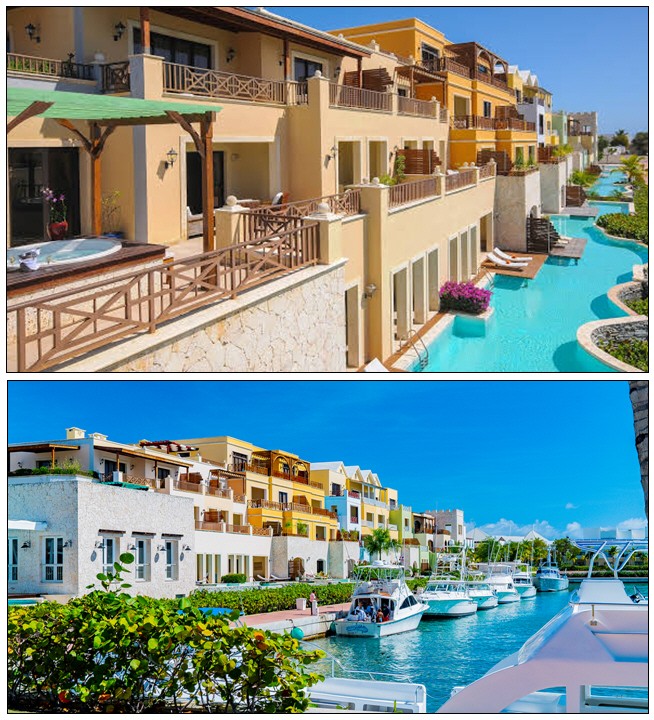

MIDDLETOWN, CT (December 23, 2024) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, has provided a $5 million hypothecation loan to Oyster Bay Resort and Coral Beach Resort, located in in the Dutch section of Saint Martin/Sint Marteen.

According to Bill Ryczek, Principal/Colebrook Financial, “We’ve been familiar with the Oyster Bay property for many years and are delighted to have the opportunity to provide financing to Mike Dolente and Josh Gold. They’re a rare breed—financiers who’ve become very successful developers. Oyster Bay and Coral Beach are beautiful properties, and the operation is first class.”

Oyster Bay principals Gold and Dolente have been the developers of Oyster Bay since 2003. Its adjacent sister property, Coral Beach Club, offers a luxury Vacation Ownership Program and a Preferred Membership with Interval International.

Josh Gold said, “Our closing went exceptionally smoothly and we look forward to doing more fundings (with Colebrook) in the future.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Oyster Bay Beach Resort and Coral Beach Club

Situated on the breathtaking eastern shores of St. Maarten, Oyster Bay Beach Resort and Coral Beach Club offer two distinct yet complementary Caribbean experiences. Oyster Bay Beach Resort combines the charm of a boutique hotel with resort-style amenities, featuring elegantly appointed accommodations, stunning ocean views, and direct access to Dawn Beach. Just steps away, Coral Beach Club elevates luxury with its exclusive collection of villas and townhomes, each designed for privacy and sophistication with private pools or terraces. Together, these sister properties provide guests with unparalleled access to pristine beaches, world-class dining, and vibrant island activities, creating unforgettable getaways for every traveler. For more information, visit oysterbaybeachresort.com and coralbeach-club.com.

Colebrook Financial Finances Indian Palms Intervals Improvements (October 2024)

MIDDLETOWN, CT (October 30, 2024) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries has provided financing to Indian Palms Intervals, an 87-unit timeshare property located in Indio, California. The HOA used the capital to upgrade the pool area with a lounge, new pool and surrounding deck area.

According to Bill Ryczek, Principal/Colebrook Financial, Indian Palms has a lengthy history and many dedicated, long-time owners. He said, “When timeshare properties age, the owners have two choices. They can re-purpose the resort and move on, or they can breathe new life into their beloved older property and give the owners a reason to keep coming back. The Indian Palms Association chose to do the latter, upgrading their amenities with a beautiful pool area. We are happy we were able to work with Management Rep Stephanie Myers, and Owen Hoskinson, Board Treasurer, to bring this project to completion. May the Indian Palms owners enjoy it for many years to come.”

Other amenities that benefitted from the infusion of funds included the BBQ area, putting green, laundry room remodel and spas. The resort also has access to a 27-hole championship golf course. Indian Palms is situated in the Coachella Valley close to the world famous Indian Wells tennis championships, scores of golf courses, hiking, music festivals and popular art shows.

Stephanie Myers, President of Vacation Leisure Maintenance Co. Inc., on the management team for Indian Palms said “working with the Colebrook team was seamless. They answered all of our questions in a timely manner and helped bring the resort property fresh new energy to ensure a memorable retreat for our owners and guests.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Vacation Club Loans Recognized as South Florida’s 2024 Fast 50 Honoree (June 2024)

MIDDLETOWN, CT (June 30, 2024) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, announced that its subsidiary, Vacation Club Loans (VCL) has joined the ranks of South Florida Business Journal’s 2024 Fast 50, recognizing the region’s fastest-growing private companies.

Melinda Miramant, CFO and Partner/Colebrook Financial, said that “Under the leadership of President Debbie Ely, VCL’s financing of Disney Vacation Club resales is at a record pace. VCL was selected for this honor based on its demonstrated growth in the past three years.”

“An award like this clearly demonstrates how having the right partners (Colebrook Financial) can positively affect the growth of our business. Their financial resources plus their deep understanding of the timeshare industry as well as our unique niche paved the way to such success,” said Ely.

The Awards ceremony will be held in August. According to the Journal, Fast 50 companies are champions of growth in South Florida –translating into jobs and newly injected cash into the community. The Fast 50 is a compilation of two Top 25 lists: one for companies with more than $25 million in annual revenue, and one for companies with less than $25 million in annual revenue. This year VCL falls into the second category.

In addition to Disney Vacation Club, Vacation Club Loans, based in Delray Beach, Florida, provides financing for the Marriott, Hyatt, Hilton, and Westin brands.

Colebrook is a pioneer in many forms of financing, which led them to VCL and resale financing. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Vacation Club Loans

Vacation Club Loans located in Delray Beach, FL, serves the United States and Canada for those who wish to purchase vacation ownership points. Its easy loan approval process and flexible payment plans for up to ten years have made it a pioneer lender in DVC financing and other timeshare resales across all brands. For further information, email Debbie@vacationclubloans.com or visit www.vacationclubloans.com

Colebrook Financial Acquires Interest in Vacation Club Loans (April 2024)

MIDDLETOWN, CT (April 4, 2024) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, announced that it has purchased a majority interest in Vacation Club Loans (VCL) which specializes in financing Disney Vacation Club® resales.

Mark Raunikar, Partner/Colebrook Financial, said that “Under the leadership of President Debbie Ely, VCL’s financing of Disney Vacation Club resales is at a record pace. Our participation, along with Debbie’s existing ownership share and Bert Blicher’s continuing involvement will enable Debbie to continue growing her business.”

Vacation Club Loans, based in Delray Beach, Florida, also provides financing for the Marriott, Hyatt, Hilton, and Westin brands.

“As a relatively new company we were quite concerned about how we would emerge from COVID. To our pleasant surprise, we actually got even busier,” said Debbie Ely. “Colebrook has been our primary lender since 2016, and we’ve worked together on deals since 2012.”

VCL’s principal owner Bert Blicher and Colebrook’s Partner Bill Ryczek have known each other since 1979.

According to Debbie Ely, RRP, CEO / Vacation Club Loans, LLC, “I truly value our business relationship with Colebrook as it has been the significant factor in our growth over the past few years. Colebrook’s ability to accommodate our unique needs and understand the resale market has been exceptional.”

Bill Ryczek, Partner/Colebrook Financial said, “When another company steps into a situation, you often hear that it will be ’business as usual.’ We are confident that it will be better than usual. Debbie will continue as CEO, while our CFO, Melinda Miramant and her staff will take over the administrative support and free Debbie up to do the marketing, service the brokers and do what she does best!”

Colebrook is a pioneer in many forms of financing, which led them to VCL and resale financing. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Vacation Club Loans

Vacation Club Loans located in Delray Beach, FL, serves the United States and Canada for those who wish to purchase vacation ownership points. Its easy loan approval process and flexible payment plans for up to ten years have made it a pioneer lender in DVC financing and other timeshare resales across all brands. For further information, email Debbie@vacationclubloans.com or visit www.vacationclubloans.com

Colebrook Financial Provides More Funding for Disney Vacation Club Resales (July 2023)

MIDDLETOWN, CT (July 30, 2023) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries announced that, due to the volume continuing to be generated by Vacation Club Loans (VCL), it has provided an additional $10 million in funding to the company which specializes in financing Disney Vacation Club® resales. This doubles its hypothecation loan to VCL, and combined with a $40 million purchase facility, increases Colebrook’s overall relationship with Vacation Club Loans to $60 million.

Mark Raunikar, Partner/Colebrook Financial, said that “Under the leadership of President Debbie Ely, VCL’s financing of Disney Vacation Club resales is at a record pace. The $10 million commitment that we closed last October has already been fully utilized, and we are pleased to announce that we recently doubled the capacity under the loan to $20 million. This will enable Debbie to continue growing her business, generating high quality vacation ownership receivables.”

Colebrook and VCL have had a relationship since 2016 and VCL’s principal owner Bert Blicher and Colebrook’s Partner Bill Ryczek have known each other since 1979.

Vacation Club Loans, based in Delray Beach, Florida, also provides financing for Marriott, Hyatt, Hilton, and Westin brands.

According to Debbie Ely, RRP, President / Vacation Club Loans, LLC, “We rely on Colebrook because they can handle transactions of most any size we need. Our success hinges on great relationships with our partners and Mark and the rest of the Colebrook Team have made the lending process relatively seamless. I truly value our business relationship as it has been the key factor in our growth over the past 7 years. Colebrook’s ability to accommodate our unique needs within the resale market as well as their responsiveness has helped tremendously factor. They are such a great group to work with.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Vacation Club Loans

Vacation Club Loans located in Delray Beach, FL, serves the United States and Canada for those who wish to purchase vacation ownership points. Its easy loan approval process and flexible payment plans for up to ten years have made it a pioneer lender in DVC financing and other timeshare resales across all brands. For further information, email Debbie@vacationclubloans.com or visit www.vacationclubloans.com

Colebrook Financial Renews it Line of Credit to MVP, a Takacs Company (Formerly TOWB/MVP) (July 2023)

MIDDLETOWN, CT (July 17, 2023) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, announced that it has renewed its line of credit to MVP, a Takacs Company. MVP is the newly combined company which includes TheMVPService, TOWB and TheMVPClub.

The funds provide for the conversion of timeshare properties to alternate uses, a sector in which TOWB, a Takacs company has been involved in since 2015. Colebrook previously financed successful conversions of Captain’s Cove in Galveston, TX, and Indian Wells, in the Palm Springs, California. Colebrook is currently financing ongoing TOWB projects in Ruidoso (New Mexico), Arkansas and California which are still in progress. The renewed line of credit will be used to fund expenses for ongoing projects.

One of the emerging trends in the industry is the decision to consider a ‘retire’ or ‘repurpose’ solution for the timeshare program at many Associations. There are numerous reasons for this; the most common is the lack of a strong secondary market.

‘MVP helps developers, HOAs and owners review all realistic options and guide them through repositioning their resort for a successful future,” explained Joe Takacs, President and CEO of MVP.

“Colebrook’s management has known Takacs since the late 1980s. Re-purposing is a relatively new field and Joe and Dana Takacs are pioneers. It takes a broad variety of skills to effectively convert timeshare resorts to alternative use and between them, Joe and Dana possess just about all of them. We are delighted to have the opportunity to provide the capital to support them,” said Bill Ryczek, Colebrook Financial Founder and Principal.

Joe Takacs related that “Colebrook is an unusual lender in that they are involved. It is a pleasure to work with them and everyone at MVP looks forward to working together for years to come.”

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About MVP, a Takacs Company

MVP, a Takacs Company is a combination of TheMVPService, Tomb and TheMVPClub. In 2007, Joe and Dana Takacs formed TheMVPService LLC, a company dedicated to establishing a commissions-based timeshare resales market without the pressure offered in so many places. Joseph is a licensed broker in 36 states and today, MVP sells onsite for timeshare associations in Florida, California, Rhode Island, New Mexico, Rhode Island, Massachusetts, Arizona, Pennsylvania, Georgia, and North Carolina. Towb was born from TheMVPService in 2018 with a singular purpose; to offer an inner circle of expertise for Boards, people that bring creativity, best practices, and courage to try new ideas to “legacy” properties. MVP and TOWB have always collaborated with HOA Boards to ask and learn what best benefits the owners and their families.

Colebrook Financial Increases InnSeason’s Receivable Loan to $15 Million (June 2023)

MIDDLETOWN, CT (June 29, 2023) – Colebrook Financial Company, a leading lender to the timeshare and vacation club industries, recently expanded its $12 million hypothecation loan to $15 million to keep with sales at InnSeason Resorts, a brand that focuses on the true “Northeast Experience.”

InnSeason has 50,000 members and six quality resorts in highly sought-after locations under their brand umbrella. Billy Curran, CEO of Inn Seasons, says 99% of their members come from the region.

According to Mark Raunikar, Partner at Colebrook, “The strong and experienced InnSeason management team does a terrific job of selling the InnSeason vacation club product as well as developing the second phase of their signature RiverWalk property in Lincoln, New Hampshire. Coordinating the loan process with COO/CFO Cathy Leyden has helped the process run smoothly and efficiently.

“We are very pleased to be working with InnSeason Resorts as they expand their brand and help more people get out on vacation in the Northeast. We know this region very well and are pleased to help support tourism and hospitality in these special locations,” continued Mark.

Dennis Ducharme, President Ducharme shared the reasoning behind working with Colebrook. “We are thrilled to have a lending relationship with Colebrook. Bill (Ryczek) and Mark (Raunikar) are extremely knowledgeable about the resort development industry, very flexible and just easy to talk to. This is very important whereby not all projects are the same—having several we know this to be true. The teams at Colebrook and InnSeason work very well together to bring success to all.”

Colebrook, celebrating its 20th anniversary, has an excellent reputation for working with developers, financial service providers and bankers to ensure smooth transactions, even in non-traditional settings.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About InnSeason Resorts

InnSeason Resorts – The Northeast Experience, was born in 1987 with the vision of sharing the uniqueness and charm of New England with the world. As New England natives, owners Billy Curran and Dennis Ducharme embarked on a journey to create the premier vacation ownership experience in the Northeast. More than 30 years later, InnSeason Resorts is the largest independent vacation ownership developer and operator in the Northeast and also one of the largest in North America. Focusing on our customers first and foremost, the InnSeason portfolio spans 6 resorts under ownership, a growing array of managed resorts, and an ever-expanding roster of member families. InnSeason Resorts is your gateway to a lifetime of memories: anticipating our guests’ every need, we are here for you to relax, unwind, and play.

Colebrook Financial Provides Loan for Re-Purposing Bay Club Condominium To Lemonjuice Capital Solutions (May 2023)

MIDDLETOWN, CT (May 16, 2023) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, announced that it has provided a loan to Lemonjuice Capital Solutions to support the re-purposing of Bay Club Condominium a 60-unit resort located in the vacation destination of Ocean City, MD.

Bill Ryczek, Partner, Colebrook Financial said, “We’ve known Scott MacGregor, Richard Winkler, and Jan Barrow of the Lemonjuice organization for many years and it’s good to be doing business with them again. The company is very well-capitalized and doesn’t require a lot of financing, and we’re pleased they came to us when they had a need.”

Colebrook is a pioneer in many forms of financing and began working with alternative vacation ownership and club products before most lenders. Few competitors can match their longevity in the industry and they enjoy a reputation for adapting to new situations more quickly than larger institutions.

Lemonjuice Capital Solutions’ Chief Operating Officer Scott MacGregor says that “In our property restructuring and recapitalization programs, we rely on agile business partners to complement our internal capabilities, and Colebrook is unique in their understanding, flexibility and responsiveness to the legacy resort environment. They’ve been great partners, and their underwriting and closing processes were fast and efficient.”

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Lemonjuice Solutions

Lemonjuice Capital and Solutions is a leading provider of professional management, strategic planning and execution, investment capital, and technology solutions for timeshares, condominiums, and mixed-use properties. With its Resorts Reimagined™ program, Lemonjuice Capital and Solutions rejuvenates timeshare resorts and condominiums, ensuring maximum value for owners. By aligning its interests with owners, stakeholders, and associations, Lemonjuice Capital and Solutions delivers innovative, results-driven solutions that foster growth and profitability. To learn more about Lemonjuice Solutions, contact Jan Barrow at 863-602-8804 or email Jan.Barrow@Lemonjuice.biz

Colebrook Financial Announces Lender Education Seminar (May 2023)

MIDDLETOWN, CT (May, 2023) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, will hold a Lender Education Seminar on May 23 at the Inn at Middletown, CT.

Bill Ryczek, Partner, Colebrook Financial said, “We’ve held these invitation only events in the past; this is the first one since the pandemic. Our goal is to educate our banking partners about the state of the timeshare industry and the new developments in the structuring of vacation products.”

Colebrook, which is celebrating 20 years of operation, enjoys a reputation as a pioneer in financing alternative vacation ownership and club products.

Two guest speakers representing a Colebrook client, Club Boardwalk Resorts (formerly Flagship Resort) (Atlantic City, NJ), will present a case study of their successful operations and how they work with Colebrook. Kevin Jones and Roxanne Passarella, Esq., co-presidents of Club Boardwalk will share their experiences and results with the group of registered attendees.

Other subjects to be covered during the morning event will be Timeshare Re-purposing Loans and Colebrook Cash Management.

“Not too many folks are aware of the situation surrounding loans to Re-purposing situations. We understand the unique requirements of this type of transaction,” said Colebrook principal Mark Raunikar, who will deliver the presentation.

The seminar is closed for registration. Colebrook will be providing a link to the content in upcoming newsletters and social media.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Colebrook Financial Provides $10 Million Fixed Rate Receivables Loan to Global Exchange Development Corporation (February 2023)

MIDDLETOWN, CT (February, 2023) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, announced that it has provided an additional $10 million in financing to Global Exchange Development Corporation (GEDC). GEDC is the development company that builds or acquires the inventory for Global Exchange Vacation Club (GEVC), finances the purchases of the timeshare memberships, is the company responsible for selling GEVC’s memberships and in doing so hypothecates the consumer notes created by the sales.

Colebrook and Global Exchange have had a relationship since 2009. GEVC is one of the most versatile and flexible vacation ownership products in the industry offering RCI points to a predominantly South Western market.

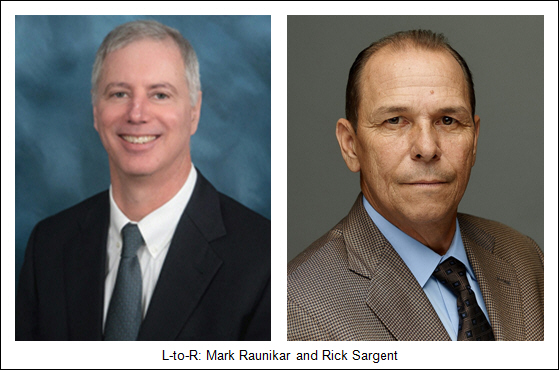

According to Rick Sargent, President / Global Exchange Development Corporation, “Thanks to Colebrook we can continue to offer our Global Exchange Vacation Club members affordable and flexible vacation opportunities in luxury accommodations all over the world. Colebrook Financial is one of the few lenders who understands the vacation club model. We differ in that we do not offer a deed to ownership, but rather allow our members customization when it comes to the length of vacation time, size of accommodations and when or where they wish to travel. Colebrook gets that.”

Mark Raunikar, Partner, Colebrook Financial said, “In this rising rate environment, we were pleased to structure a transaction that enabled Global to convert variable rate debt to a fixed rate, lower its borrowing costs, and lock in a profit. It has been a great pleasure working with GEVC over the last 13 years, and we look forward to working with Rick for many years to come as he continues to manage his business with unmatched energy and optimism.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Colebrook Financial Celebrates Its 20th Anniversary (January 2023)

MIDDLETOWN, CT (January, 2023) – A review of the events of early 2003 yields little but bad news. There were bombings in the Middle East, the space shuttle Columbia disintegrated in space with fatal consequences, and President George W. Bush and Iraqi strongman Saddam Hussein vied to see which was the toughest hombre of them all.

But amidst the chaos and angst of early 2003 was a ray of good news. On Thursday, January 2, four partners of Colebrook Financial Company unlocked the door of their office at 100 Riverview Center in Middletown, Connecticut, determined to find out whether they could earn a living making timeshare loans.

Each partner had resigned from his banking job, forsaking a steady salary, benefits, and security. For Bill Ryczek, it wasn’t the best time to abandon security. His son had begun college a few months earlier and his daughter was a senior in high school. “There’s no perfect time to launch a new venture,” Bill said recently. “But we were old enough to have some experience and young enough to have the energy for an extended run. I was dramatically underpaid in my last banking job, which turned out to be a blessing in disguise. If I was making a market salary or even close to it, it would have been a much more difficult decision to leave, and I might not have done it.”

Mark Raunikar was the youngest partner. “I was ready for a change,” he said “after working for the same company for 15 years straight out of college. I was excited but apprehensive, and had done everything I could to cut my living expenses. But I also knew I was young enough to start over if things didn’t work out like we planned.”

Linda Heller is only other original partner still active. Her role as silent partner is a little different, since she wasn’t giving up a full-time job, but she had the strongest financial statement, and if things went badly, she was likely to be the one the banks would look to first. "I had confidence in the abilities of my partners,” Linda said, “and knew about their expertise, experience, determination, and most of all their extraordinary perseverance. I was confident that we’d be successful, and my confidence has been rewarded. All of those qualities are reflected in the business we have today.”

It’s 20 years later. Bill’s children have long since graduated from college, Mark has been able to loosen his financial belt a little, and Linda’s guaranty was never called. It turned out that the timeshare industry had room for a company large enough to make substantial loans but small enough to pick up the phone and deliver straight answers. But that was far from a certainty on that January day in 2003 when four apprehensive partners placed a heavy bet on an idea, a fragile confidence, and the optimism requisite of an entrepreneur. “When I look back at the financial results of the first year,” Bill recalled, “I think now that I probably should have been more worried than I was, but I never felt a sense of panic. We always had irons in the fire.”

Staying in business for 20 years requires continuous adaptation, especially in the dynamic timeshare industry. The past two decades have witnessed consolidation and a steep decline in the number of independent developers, the advent of points-based and travel club products and, recently, the re-purposing of older timeshare properties. A small company can be nimble, but people who’ve been in an industry for several decades can be resistant to change. Colebrook’ partners haven’t allowed old habits to inhibit new ideas, which is what’s enabled them to celebrate their 20th year in existence.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Colebrook Financial Company Announces Hypothecation Loan for Gold Point Lodging and Realty (January 2023)

MIDDLETOWN, CT (January, 2023) – Colebrook Financial Company, a leading lender to the timeshare industry, has announced it has renewed a $12 million line of credit to Gold Point Lodging and Realty, part of the Breckenridge Grand Vacations (BGV) companies) to finance sales at Breckenridge Grand Vacations’ (BGV) Grand Timber Lodge.

Created in 1984, Breckenridge Grand Vacations (BGV) was built by brothers Mike and Rob Millisor and friend Mike Dudick upon the belief that the success of their company would be determined by the positive impact it had on their owners and guests, employees, and the community. The developers of the company also embraced the concept that BGV would be the best in sales if they were first and foremost the best in customer service. BGV now creates Grand vacations for over 30,000 owners.

The recent renewal emphasizes the value Colebrook Financial Company places on long term relationships. Breckenridge Grand Vacations has been a customer since 2009. “Breckenridge Grand Vacations is one of the largest and best independent timeshare developers in the United States and we’re delighted to have had an excellent relationship with them since 2009. Each of their properties is more spectacular than the last, even though that didn’t seem possible when the last one opened. Somehow, they manage to outdo themselves every time,” said Tom Petrisko, Principal of Colebrook.

Blake Davis, CFO of Breckenridge Grand Vacations adds: “Our goal at BGV is creating smiles. Working with Colebrook certainly produces smiles on our part. Over the past decade we’ve seen first hand how they continually look at different perspectives to make the process and results more beneficial to all concerned.”

Colebrook is a pioneer in many forms of financing. They began financing club products before most lenders. Few competitors can match their longevity in the industry. Bill Ryczek started in 1979, Mark Raunikar in 1988 and Tom Petrisko in 1998. Yet, this experienced and nimble management team adapts to new situation more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Gold Point Lodging and Realty Inc.

Gold Point Lodging & Realty Inc. manages Grand Timber Lodge.

Grand Timber Lodge: The perfect mountain resort in the perfect mountain town. Located just off the slopes of the Breckenridge Ski Resort, Grand Timber Lodge is the perfect place for making family memories year-round. The resort provides quick access to all mountain activities, while being just a short walk from Breckenridge’s bustling Main Street.

With residences ranging from studio units to four-bedrooms, Grand Timber Lodge has the perfect accommodation size to fit any group. Residences that are one-bedroom and larger feature ample square footage, fully-stocked kitchens, gas fireplaces and balconies. Resort amenities include: multiple indoor/outdoor pools and hot tubs, The Boot restaurant and bar, fitness center, private theaters, family game room and more.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Provides Funding for Disney Vacation Club Resales (December 2022)

MIDDLETOWN, CT (December, 2022) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries announced that it has provided an additional $10 million in financing to Vacation Club Loans which specializes in Disney Vacation Club resales. This brings the total loan amounts provided by Colebrook to Vacation Club Loans (VCL) to $50 million.

Colebrook and VCL have had a relationship since 2016 and VCL’s principal owner Bert Blicher and Colebrook’s Partner Bill Ryczek have known each other since 1979. Colebrook previously provided financing for sales at Blue Water Resort in Nassau. CEO Bert Blicher and VCL President and co-owner Debbie Ely were active in the Blue Water transaction.

Mark Raunikar, Partner, Colebrook Financial said, “Financing timeshare resales has always been a challenge, and Debbie has taken that challenge and run with it. It’s been truly gratifying to see her start from zero and build a thriving resale finance company. We look forward to working with her for years to come.”

According to Debbie Ely, RRP, President / Vacation Club Loans, LLC, “Colebrook is absolutely wonderful to work with. Their responsiveness and ease of funding are a key point in our success.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

Colebrook is a pioneer in many forms of financing including getting involved with club products before most lenders. With roots in traditional timeshare lending, few competitors can match Colebrook’s longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions as well as maintaining long-lasting relationships industry-wide. They are approaching their 20-year anniversary.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Vacation Club Resorts

Vacation Club Loans located in Delray Beach, FL, serves the United States and Canada for those who wish to purchase vacation ownership points. Its easy loan approval process and flexible payment plans for up to ten years have made it a pioneer lender in timeshare resales across all brands. For further information, email Debbie@vacationclubloans.com or visit www.VacationClubLoans.com.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Increases Flagship Resort's Loan to $20 Million (September 2022)

MIDDLETOWN, CT (September 13, 2022) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries has extended and increased its hypothecation loan to Flagship Resort Development Corp. to $20 million. Flagship owns and operates a trio of resorts in Atlantic City, New Jersey.

The Flagship Resort is located where Atlantic City’s Historic Boardwalk begins. The family-friendly 32-story property is known for exceptional views which owners can enjoy from their own private balcony. Called an oasis in the sky, Flagship features studio, one-bedroom, and two-bedroom suites as well as dining, shopping, and spa amenities.

Atlantic Palace Resort is centrally located on the Atlantic City boardwalk, while La Sammana, a smaller, boutique property, is across the inlet in Brigantine.

Flagship’s Jim Casey said, “ I love Colebrook. They have a wealth of knowledge, are great guys and they KNOW how to lend! I’ve known and trusted Bill Ryczek for 40 years! ”

“It’s been rewarding to see Kevin Jones and Roxanne Passarella steadily increase the volume of the Flagship sales operation. Colebrook and Flagship have a relationship going back to 2009 and now, as they are experiencing new growth, we’re excited to increase our loan to accommodate that upswing. We look forward to many years of working with the company,” said Colebrook principal Tom Petrisko.

Colebrook is a pioneer in many forms of financing including getting involved with club products before most lenders. With roots in traditional timeshare lending, few competitors can match Colebrook’s longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions as well as maintaining long-lasting relationships industry-wide. They are approaching their 20-year anniversary.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Fanta Sea Resorts

Since 1991, FantaSea Resorts has enriched lives by providing affordable, dream vacation opportunities to thousands of families in the Tri-State and Delaware Valley. It is our belief that quality downtime should be honored and easily attained, even amidst the most hectic lifestyles. FantaSea Resorts is proud to be the premier provider of vacation ownership products and services in the Northeast, and one of the largest privately owned hospitality companies in Atlantic City. With 45,000 vacation owners and growing, FantaSea Resorts supports its mission through strategic alliances with leaders in worldwide tourism and progressive development in Atlantic City. Our timeshare exchange partnerships allow vacationers to exchange their weeks anywhere around the world and to choose from over thousands of affiliated resorts in over 100 countries.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Finances Vacatia's Acquisition of Liberte Management, LLC (August 2022)

MIDDLETOWN, CT (August 29, 2022) – Colebrook Financial Company, a leading lender to the timeshare and travel club industries has provided financing to Vacatia Inc., a leading provider of innovative, customer-centric solutions for timeshare resorts, to acquire Liberté Management Group. Liberté Management Group, a Vacatia Company, manages six Florida properties located on St. Pete Beach, Redington Shores, Madeira Beach, Treasure Island and Belleair Beach.

Vacatia is an innovative hospitality company offering resort residence rentals and timeshare resales. The Mill Valley, California–based company also partners with timeshare homeowner associations to ensure long-term vitality and care for the resorts and owners. Including the Liberté properties, Vacatia now manages 4,750 units in eight states.

Bill Ryczek, partner, Colebrook Financial said, “Vacatia is one of the leading management companies in the timeshare industry. Their ability to rent timeshare inventory is invaluable to independent resorts. We’re pleased to help with the acquisition of Liberté and look forward to expanding our relationship with Vacatia.”

According to Michelle DuChamp, head of Vacatia Partner Services, “We are dedicated to the success of independent resorts and their vibrant owner communities. Colebrook Financial understands our customer-centric products and our commitment to help resorts drive owner engagement, attract new members and finance property renovations. Their deep expertise in the timeshare resort industry and flexibility when it comes to financing innovative vacation models drove our decision to work with them.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal. For a complete list of product offerings and information on Colebrook and its principals, visit www.colebrookfinancial.com

About Vacatia Partner Services

Vacatia has rapidly grown its property management services to 4,750 units in eight states. Management services are just one of the fresh solutions offered by Vacatia, which has 750 industry partners, including some of the largest timeshare companies, relying on it for rental and resale services. Their products drive owner engagement, improve cash flow, attract new members and even finance needed property renovations. Vacatia Partner Services (VPS) is the division of Vacatia that works with property management companies and independently managed associations across the country to help timeshare resorts thrive in the modern era. To learn more about VPS’s rental, resale, subscription membership products and property management services, and how they are reinventing the timeshare experience across discovery, booking, and stay, call (720) 449-6738 or visit vacatiapartnerservices.com.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Announces Capital Improvement Loan for Pollard Brook Home Owners Association (April 2022)

MIDDLETOWN, CT (April 14, 2022) —Colebrook Financial, a leading lender to the timeshare industry, closed a receivable financing facility with InnSeason Resorts in 2021 and is now following that up with a capital improvement loan for one of its owners’ associations.

Rather than do improvements in stages, the Pollard Brook HOA, which manages the company’s Pollard Brook Resort in Lincoln, New Hampshire has opted to do all the renovations at once; the loan will allow the association, with the professional guidance of the InnSeason property management team, to finance indoor and outdoor pool and hot-tub amenity upgrades at the resort.

Mark Raunikar, Partner/Colebrook Financial, said, “We are excited to expand our relationship with the InnSeason organization by extending this Association loan. We are proud that HOAs such as Pollard Brook come to us for good service and guidance, and hands-on attention which some larger lenders cannot provide.”

Colebrook is one of the most prominent lenders to timeshare homeowners’ associations in the nation. Most association loan requests are too small to interest national timeshare lenders and too unusual and complex for the local bank. Raunikar says Colebrook has filled that void with a product that allows associations a vehicle to finance needed improvements.

Colebrook, with its extensive timeshare expertise and lack of bureaucracy, can underwrite requests quickly, and can close loans with minimal legal expense.

If you want to discuss your situation and see whether a loan might be the best course for you, call 860-344-9396 and ask for Bill, Mark Raunikar, or Tom Petrisko.

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal. For a complete list of product offerings and information on Colebrook and its principals, visit www.colebrookfinancial.com

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Lends to Mexican and Caribbean Resorts (April 2022)

Middletown, CT (April 2022) – Colebrook Financial, a leading lender to the timeshare industry, has been lending to Mexican and Caribbean developers for nearly 20 years. Because of limited availability, most developers in those markets have learned to live without financing. They have a business model in which they generate enough money from cash sales and down payments to pay sales and marketing expenses, and if they offer financing, it’s usually on a short-term basis.

There are times, however, when those developers want to monetize a portfolio for an acquisition or other purposes or believe that the ability to offer financing would increase their sales. In those instances, Colebrook has stepped up to provide a loan or purchase facility.

“There are challenges to financing foreign portfolios,” said Colebrook’s Bill Ryczek. “Laws are different, customs are different, and documentation is different. We finance U.S. and Canadian buyers in U.S. dollars, and as a non-bank, we aren’t subject to the strict regulation that prevents institutional lenders from operating in off-shore resorts.”

“With a more personal approach,” Ryczek says, “Colebrook has been able to provide both loan purchase and hypothecation facilities that provide developers with cash flow for sales, marketing, and capital improvements. We believe we have the ability to assess risk and, while our transactions are fully-documented, we try to accommodate the local legal and business environment.”

As perhaps the most creative lender in the timeshare industry, Colebrook can often find ways to accommodate situations that other lenders cannot. “If it’s a sound operation, we can usually find a deal in there somewhere,” said Ryczek, “and provide the developer with some liquidity.”

If you’d like to talk about financing, call 860-344-9396 and ask for Bill, Mark Raunikar, or Tom Petrisko.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Look Inside the Fascinating Mind of a Lender (March 2022)

Colebrook Financial Company Webinar Shares Criteria Used to Evaluate Hypothecation Loan Requests (March 2022)

Middletown, CT (March 2022) – Colebrook Financial Company, a leading lender to the timeshare and vacation club industries, announces the availability of a new, online webinar offering insights into the criteria Colebrook uses to evaluate hypothecation loan requests. The webinar may be viewed here.

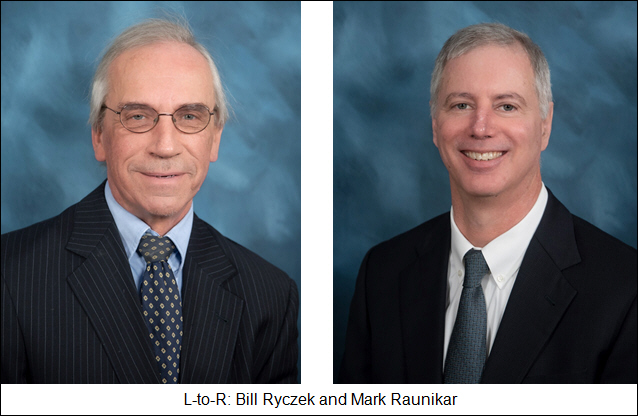

Colebrook partners Bill Ryczek and Mark Raunikar talk about concepts that will help developers applying for timeshare or vacation club funding understand what goes into the decision process and how their process might differ from that of large financial institutions.

“We’ve been lending to resort developers for a long time,” says Ryczek. “I can pretty much tell within a few minutes of conversation whether we have a deal or not. Our experience helps us understand what it takes to make a successful project.”

The webinar lays out what developers need to know when approaching a lender. Specifically, it explains the way Colebrook approaches a loan request and how they work closely with small and large developers with varying needs. Mark pointed out that it’s far more important to emphasize the mitigation of risk rather than the potential for large profits.

Colebrook is a pioneer in many forms of financing and is always one of the first to comprehend the latest iteration of the timeshare industry, adapting much more quickly than larger organizations. Colebrook principal Bill Ryczek started in 1979, Mark Raunikar in 1988, and Tom Petrisko (who was on special assignment and does not appear in the webinar) in 1998. To view the video click here.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Zealandia Calls on Colebrook Financial Company's Flexibility for Three Loans in Three Months (Feb 2022)

Zealandia Calls on Colebrook Financial Company’s Flexibility for Three Loans in Three Months (Feb 2022)

Middletown, CT (February 2022) – Colebrook Financial Company, a leading lender to the timeshare and vacation club industries, announced that Zealandia Holding Company has engaged their services for three loans in the past three months.

Two of the loans were made to HOAs. The first was for the Atlantic Beach Resort II (Atlantic Beach, NC). Atlantic Beach, located on the “Crystal Coast,” is one of the oldest resort towns along the Bogue Banks of North Carolina’s Coast. The second HOA loan was made to LaTour Hotels and Resorts (Zealandia’s resort management company) which in turn loaned the proceeds to the HOA of Coconut Palms (New Smyrna Beach, FL). The third agreement was for a bridge mortgage loan for Festiva Orlando Resort (Kissimmee, FL), which has been partially re-purposed from timeshare to apartments.

Zealandia Holding Company, Inc., (Asheville, NC) is a diversified company that provides services to timeshare owners and homeowners’ associations through its family of subsidiaries dedicated to focusing on specific aspects of the hospitality and vacation ownership industry, including member services, financing, collections, sailing vacations, and property management. The company is no longer in active timeshare sales and focuses on owner services and re-purposing its projects to their highest and best uses.

“When the Zealandia organization stopped making timeshare sales, it looked as though Colebrook’s relationship with the company might come to an end,” said Colebrook’s Bill Ryczek, “but over the past year, activity has been as strong as ever.” Colebrook’s extensive knowledge of the resort industry and their flexibility enables them to provide financing that very few lenders offer, and they’ve worked with Zealandia’s management to assist them with their various initiatives.

Working with Butch Patrick, CEO, President & Co-Founder of Zealandia Holding Company, Inc. since 2003, Bill Ryczek, principal of Colebrook, said, “We’ve done business with Butch and his companies for many years; it has been interesting and rewarding to see him build an organization and adapt it to changing circumstances. We’re delighted to have this opportunity to work with them once more.”

“It’s rare,” said Patrick, “to find a lender that is proactive, foresees potential issues and works to resolve them in advance. Bill and I have known each other for almost 25 years and our companies have both adapted to changing circumstances; it’s great to know that Colebrook understands our business and how it is evolving.”

Colebrook is a pioneer in many forms of financing and is always one of the first to comprehend the latest iteration of the timeshare industry, adapting much more quickly than larger organizations. Yet they’re big enough to consummate transactions of $30 million or more. And few competitors can match their longevity in the industry. Colebrook principal Bill Ryczek started in 1979, Mark Raunikar in 1988, and Tom Petrisko in 1998. Long experience in a field can be inhibiting if one is locked into the old way of doing things, but it’s a tremendous advantage when used to better understand the current situation. That’s what the Colebrook principals strive to do.

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

About Zealandia

Zealandia Holding Company, Inc. (ZHC) is a value-added strategic investor formed to leverage the assets, business synergies, and professional teams of ZHC and its subsidiaries. Since its inception, ZHC has acquired or invested in 22 companies covering a wide range of resort properties, hotels, and multi-family real estate and related businesses. ZHC’s strong, 21-year history of operational excellence, brand development and sector expertise combine to further its mission to provide the necessary capital, core function management, and strategic leadership needed for sustained growth. With a focus on investing in Travel & Leisure related businesses as well as a variety of diverse businesses outside of the hospitality space, ZHC (www.ZHCompany.com) is uniquely positioned to provide the resources and relationships necessary to maximize the value of our companies.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Company Finalizes $12 Million Hypothecation Loan for InnSeason Resorts (Sept 2021)

Northeast Developer with Six Unique Resorts Continues to Grow

Middletown, CT (September 20, 2021) -Colebrook Financial Company, a leading lender to the timeshare and vacation club industries, closed a $12 million hypothecation loan for InnSeason Resorts, a brand that focuses on the true “Northeast Experience.”

InnSeason has 50,000 members and six quality resorts in highly sought-after locations under their brand umbrella. This fall, their award winning Riverwalk Resort will begin Phase II. The east coast company also acquires inventory in key vacation destinations to meet member travel demands.

Dennis Ducharme, President and COO, and his partner Billy Curran, CEO, came together to form the InnSeason brand in the early 2000s. Both had been developing properties for at least two decades prior to creating the InnSeason brand. According to Billy Curran, the company is distinctive in that 99% of their members come from the region.

Ducharme shared the reasoning behind working with Colebrook.

“Everyone is excited about working with Colebrook. In the timeshare business, relationships are extremely important. Over the years we’ve come to know the principals, even when we were working with another lender. As a midsize regional developer our portfolio could easily be lost with a large institution. With Colebrook we are assured to receive hands on service, good guidance and the attention we deserve.”

Shaun O’Neill, President of Concord Servicing, which handles portfolio management for InnSeason, says that Colebrook is unparalleled in providing lending to the timeshare industry. “InnSeason will be in expert hands working with them.”

Mark Raunikar, Principal at Colebrook, is proud of the relationships Colebrook maintains with developers, financial service providers and bankers to ensure smooth transactions, even in non-traditional settings. He said “Whether it’s a points-based club, a vacation club or fixed weeks residing in trust, we are known for our innovative approach, structuring deals which make sense for everyone. We are particularly looking forward to working with InnSeason as we know this region and regard them highly. Our relationship with Concord dates to its formation in 1988 and it has consistently provided excellent portfolio servicing and custodial services for Colebrook. The experience and professionalism of the InnSeason and Concord teams were instrumental in closing this transaction that incorporated multiple resorts and vacation products.”

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

Colebrook Financial Announces Line of Credit for StaySaver Vacations (July 2021)

Middletown, CT; July 12 2021 – Colebrook Financial Company, a leading lender to the timeshare and travel club industries, has provided a $5 Million line of credit for travel club receivables to StaySaver Vacations. StaySaver offers members affordable and flexible travel through an online booking experience for everything from condo vacations to cruises.

Bill Ryczek, Principal at Colebrook

Bill Ryczek, Principal of Colebrook Financial said: “”We’ve known some of the StaySaver principals for many years. They’ve assembled a formidable team, are growing quickly and we look forward to a long, rewarding relationship.”

Colebrook is a pioneer in many forms of financing and began working with club products before most lenders. Few competitors can match their longevity in the industry. They enjoy a reputation for adapting to new situations more quickly than larger institutions.

Headquartered in Las Vegas, StaySaver has a reputation for delivering outstanding vacations through its powerful online reservation portal. The Travel Club also has sales offices in Miami and Virginia Beach. In business for just over a year, the company has a team of seasoned travel professionals at the helm, including Larry Biondi, Kevin Sheehan, Jose Hernandez, and Anthony Polvino.

Larry Biondi of StaySaver said “Colebrook Financial has been way ahead of the curve when it comes to financing travel clubs. The present climate is excellent for consumers who want travel flexibility at a reasonable price point. We are pleased that Colebrook is forward thinking and supports our business model.”

About Colebrook Financial Company

Colebrook Financial Company, based in Middletown, Connecticut, specializes in providing financing for the timeshare industry, and can offer a variety of facilities in amounts ranging from $100,000 to $30 million or more. We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. Colebrook has no committees, and our most important policy is common sense. You’ll get straight answers, and you can always talk to a principal.

Contact:

Bill Ryczek, 860-344-9396

Media:

Georgi Bohrod, RRP

760-803-4522

$15 Million Line of Credit for Sapphire Resorts Receivables Renewed by Colebrook Financial (July 2021)